High Commodity Prices: Are You Investing for the Upswing — or the Downturn?

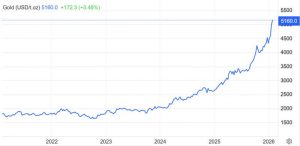

With gold above $5,000/oz, silver near $100/oz, and copper exceeding $6.00/lb, the industry is operating in a very different margin environment than it was just a few years ago.

When prices surge, capital follows.

Suddenly:

- Lower-grade deposits look economically viable

- Higher-risk operating environments make financial sense

- Projects that were previously shelved become attractive again

An uptick in capital project activity is not surprising. Elevated margins expand the feasible envelope for investment.

But there is an uncomfortable reality in mining and large-scale processing industries:

It still takes 10–20 years to move from discovery to production. Even brownfield expansions often require 4–8 years to permit, design, construct, and ramp up.

The commodity price that triggers today’s investment decision is unlikely to be the price environment when the project reaches steady-state operation.

That raises a more immediate and strategic question:

How Do We Capture Today’s Margins… Today?

The answer is not always large, bold, or capital-intensive.

When margins are high, we do not need step-change improvements to generate meaningful returns. Small, disciplined operational gains suddenly translate into significant financial impact.

Yet the first levers many organizations pull during price spikes are often short-term in nature:

- High grading

- Deferring maintenance

- Pushing throughput at the expense of recovery

- Sacrificing long-term reliability for immediate tonnage

These approaches can improve short-term financial performance, but they effectively borrow from the future. Deferred maintenance compounds. Reliability erodes. Process instability increases. Eventually, the cost arrives, with interest.

Re-examining the “Low-Hanging Fruit”

During lower-price environments, many incremental improvement opportunities are dismissed because the return appears marginal. The effort does not seem justified relative to the margin environment.

But at elevated prices, those same incremental improvements become extremely valuable.

Consider operational friction that often goes unaddressed:

- Minutes lost at shift change due to inefficient handover

- Chronic slowdowns where equipment is operated a few percent below target to “protect” it

- Short stops that disrupt steady-state operation in sizing, flotation, gravity, or separation circuits

- Conservative operating practices that persist simply because “we’ve always done it this way”

Individually, these losses seem small. Collectively, they represent meaningful capacity and recovery opportunity, especially when every additional tonne or percentage point carries elevated value.

The advantage of focusing here is that many of these issues can be resolved with modest capital and disciplined execution rather than major project cycles.

Investing for Resilience, Not Just Growth

Commodity cycles are not new. Periods of strong pricing are historically followed by correction.

The organizations that outperform over the long term are not simply those that expand during the upswing, they are those that use the upswing to strengthen their operating system.

That may include:

- Eliminating chronic sources of instability

- Modernizing maintenance practices

- Improving planning discipline

- Tightening process control around bottlenecks

- Building better data visibility into production losses

These investments may not be as visible as a new mill or expansion project, but they compound over time and reduce vulnerability when margins compress.

A Strategic Use of Free Cash Flow

High-price environments provide something rare: optionality.

The key question is not only where to deploy capital for growth, but how to deploy capital to:

- Increase operating resilience

- Reduce structural inefficiencies

- Strengthen reliability

- Protect bottlenecks

- Improve planning accuracy

The next downturn will arrive, it always does. The margin environment simply determines how much time we have to prepare.

The organizations that treat strong commodity prices as an opportunity to improve discipline, eliminate chronic waste, and reinforce their operating foundations will be better positioned when conditions tighten.

The real advantage of high prices is not just expanded profit.

It is the opportunity to build a stronger system before the cycle turns.